At first I thought it was a political ploy. President Obama proposed cutting $2.6 billion from the Low Income Home Energy Assistance program (LIHEAP), a 50% reduction in funding from last year. Did he think that proposing cuts for poor people would enhance his approval rating among Americans intent on cutting government benefits for others?

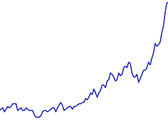

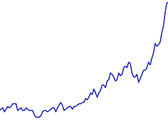

Then I got the facts. This was not really much of a cut at all. You see, the budget for this program had been doubled in 2008 in response to oil prices that doubled between June 2007 and June 2008, hitting an all-time record high price of almost $148 per barrel in July 2008. When President Obama unveiled his budget proposal earlier this month, oil prices had stayed under $90 per barrel and natural gas prices had also remained fairly steady for all of 2010. Under those circumstances, President Obama merely proposed to restore the Low Income Home Energy Assistance program to its pre-2008 oil crisis funding levels.

The assumptions underlying President Obama's proposed funding for this program may turn out to be inaccurate given ongoing events in the Middle East. Since the historically high oil prices in July 2008, however, Saudi Arabia has intervened several times to keep the price of oil at or below $100 per barrel. The Saudis have recently pledged to make up any shortfall caused by the current unrest in Libya. They understand that prices significantly above $100 per barrel would jeopardize the global economic recovery. Sustained prices at those levels would also result in reductions in oil consumption as efficiency, conservation, and alternative energy sources became more attractive.

Will the Saudis succeed in managing the price of oil? Unlikely in the long term because growing demand and the absence of significant new supplies will continue to put upward pressure on prices. But in the short term, it is reasonable to assume that the Saudis will be able to prevent the types of price spikes we saw in 2008. President Obama's proposed budget allocation for LIHEAP should be sufficient to prevent people from freezing.

What if events in the Middle East spiral out of control and oil prices skyrocket? The President and Congress will have to revisit the issue and do what they did in 2008 -- provide additional funding for the Low Income Home Energy Assistance program in response to an emergency. But given the state of our economy and its dependence on oil, that would be only one of many serious challenges.

John Howley

Orlando, Florida

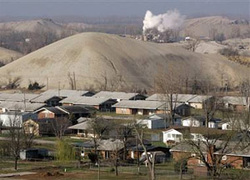

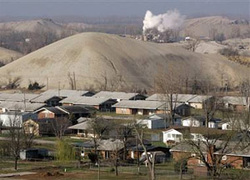

Proposals to gut the EPA's enforcement budget coincided this week with the dismantling of Picher, Oklahoma, a former mining town that is caving in on itself and so polluted that it is no longer safe for people to live there. From the 1920's until the 1950's, Picher was at the center of the lead and zinc mining capital of the world -- the intersection of Oklahoma, Kansas and Missouri. By 1983, however, Picher was identified as the epicenter of one of the most toxic areas in America due to mine waste that had contaminated the water. Studies showed that about one-third of the children in Picher had elevated levels of lead in their blood, a condition that can cause cognitive and learning disabilities. A local school board member recalls generations of young people in Picher who struggled to learn. There was no EPA during Picher's mining heyday. No agency to test the drinking water or otherwise ensure that mining and industrial operations would be conducted without harming the health of residents. It was an era that gave us places like Love Canal, New York (the Niagra Falls neighborhood where 800 families had to be relocated because of toxic chemicals buried in the ground), and Times Beach, Missouri (another town that no longer exists because of life-threatening dioxin levels in the drinking water), and Woburn, Massachusetts (another high profile incident of water contamination and the subject of the book and movie, A Civil Action). It was an era when babies of working class families were poisoned in blissful ignorance. Do we really want to return to an era when the lives of working class people and their children will be destroyed by untested and unregulated mining and industrial practices? As we consider the economic benefits and costs of using hydraulic fracturing ("fracking") to recover more natural gas from shale formations, do we really want to move forward without a government agency investigating the potential environmental and human harms? Do we want to take the risk of creating new Pichers, and Love Canals, and Times Beaches, and Woburns? Or do we want to get it right this time?John HowleyOrlando, Florida

When President Obama announced his proposed budget, he did it in the the traditional fashion. By rolling out reams upon reams of printed paper. Maybe it makes for a nice photo op. Maybe it gives government workers something to do. But it is an extraordinarily wasteful way to disseminate information in the 21st century.Think of all the energy that was wasted -- and all the greenhouse gases that were emitted -- by chopping down trees to produce the paper, transporting the ink and paper to printing presses, running the printing presses, and transporting the printed documents to the White House and Congress. All this energy and expense to produce a document that most people will never read and that will end up as waste paper in a matter of a few weeks. There is a better way. We could save money, reduce carbon emissions, and more effectively get documents into the hands of the people by distributing them electronically. After all, we live in an era when grandmothers have e-readers and Facebook accounts. None of them is going to see the massive budget proposal in printed form. But if you put it on line and made it searchable, many Americans would take a look. So why are we spending hundreds of millions of dollars to print documents that are less accessible to Americans than they should be? President Obama has implicitly recognized this waste by proposing to eliminate the practice of printing and mailing the Federal Register (which is available on line). This one act will save $16 million in printing and mailing costs. Why stop there? Why not eliminate all spending on printing government documents? Why not transition to a 21st century practice of making government documents more accessible, less costly to produce, and less harmful to the environment by stopping the presses and distributing everything on line?John HowleyOrlando, Florida

The price of coal is expected to increase 55% in the next two years, to a peak price of $170 per tonne in 2012 from $110 today. The price of oil is expected to increase more than 100% in the next three years, to a peak price of $200 per barrel in 2013 from under $100 today.The price of wind is expected to remain the same over the next 2, 3 and even 10 years, to a peak of zero from zero today. Ditto with the price of the sun's rays.Now if China builds hundreds of gigawatts of coal-fired and diesel-fired power plants over the next 10 years, and we build hundreds of gigawatts of wind and solar farms in the same time period, we will pay more for our energy infrastructure in the short term. But they will be stuck with ever-increasing and ongoing costs to fuel their coal-fired and diesel-fired power plants, while we will enjoy zero fuel costs for our wind and solar farms. We will have a very significant competitive advantage in energy costs, which will allow us to hire more people and pay them more. Ten years from now, China's leaders might look back and say, "We kept buying US Treasury bonds, thereby lending money to the Americans so they could build wind and solar farms that are more efficient and less expensive than our coal-fired plants? Now the Americans have a competitive energy advantage courtesy of our low-cost financing? What were we thinking?"Or we could look back and say, "We borrowed billions from China by issuing Treasury bonds, and we wasted all that money on traditional fossil fuel power plants that now require us to pay ever-increasing prices for coal and oil? What were we thinking?"What about the intermittent nature of wind and solar? How can we rely on energy sources that are as fickle as the wind and the sun?First, let's understand that our use of energy is also intermittent. For example, we use more air-conditioning on hot days when the sun is shining, which is also when solar panels produce the most electricity. Second, let's understand that we can address some of the concerns by bulding a smarter grid (which we need anyway; the current one is based on technology that is 100 years old) and by driving more plug-in electric vehicles (which can serve as a distributed storage system; charging car batteries when electricity supply is plentiful). Most of all, let's understand that no one is suggesting that wind and solar can meet all of our energy needs. Renewables can supply 20% of our energy needs in the next 10 years. Combine that with a 20% increase in energy efficiency, and we will have reduced our reliance of fossil fuels by 40%.A 40% reduction in fossil fuel reliance would give us a distinct competitive advantage in the world economy. Not to mention less need to drill for oil in sensitive environmental areas, less concern about whether undemocratic states will use the money we pay for oil to fund terrorists, etc. Plus, we have plenty of coal that we can ship to China at ever increasing prices, thereby reducing the trade deficit. So, do we want to pay now for wind and solar farms that will give us a competitive energy advantage? Or do we want to pay later with higher fuel prices and an uncompetitive economy? John HowleyOrlando, Florida

Most people talk about carbon taxes, cap and trade, and other carbon-related costs and regulations as if they were something new and unusual. In fact, most companies already face a very complex environmental and Greenhouse Gas (GHG) regulatory system that includes both private standards and government laws and regulations. The private and public restraints on GHG emissions range from the Walmart Sustainability Index that requires 100,000 Walmart suppliers to disclose their carbon footprints and sustainability initiatives, to regional GHG cap and trade programs that require power plants to reduce their emissions or purchase allowances in an open auction. And, of course, the 1990 Clean Air Act Amendments instituted a cap and trade program for acid rain that achieved 100% compliance in reducing sulfur dioxide emissions during the 1990's.The most prominent GHG cap and trade program today is the Regional Greenhouse Gas Initiative (RGGI). The ten Northeastern and Mid-Atlantic states that comprise RGGI have agreed to a mandatory, market-based effort to reduce greenhouse gas emissions. The member states have capped CO2 emissions from the power sector with the goal of reducing those emissions by 10% by 2018. States sell nearly all emission allowances through auctions and invest proceeds in consumer benefits: energy efficiency, renewable energy, and other clean energy technologies. Similarly, the Western Climate Initiative (WCI) is a collaboration of seven western US states and three Canadian provinces working together to identify, evaluate, and implement policies to reduce greenhouse gas emissions, spur investment in clean-energy technologies that create green jobs, and reduce dependence on imported oil. WCI has announced plans to implement a cap-and-trade system in January 2012 that will provide financial incentives to reduce carbon emissions. The program will start with power plants, then extend to large industrial producers and transportation. These GHG cap and trade programs, however, are only the highly visible tip of the iceberg. Almost every company in the US faces a complex web of private standards and public laws that regulate their GHG emissions, other environmental impacts, and overall sustainability. CERCLA, RCRA, NEPA, the Clean Air Act, the Clean Water Act, the Safe Drinking Water Act, the Ocean Dumping Act, and the Endangered Species Act are just a few of the US laws regulating the environmental impacts of companies and individuals in the US. Companies that export to Europe must also be aware of the specific regulatory, green labeling, and other environmental requirements in the European Union and locally. My good friend Stan Alpert believes that smart companies can use their compliance with environmental regulations as a competitive advantage and ultimately to reduce costs. Stan should know. In addition to working for many years as the Chief Environmental Prosecutor in the U.S. Attorney's Office that covers parts of New York City and all of Long Island, Stan has extensive experience as a lawyer in private practice advising green and sustainable businesses. Stan has put together a free online webinar entitled Sustainability is Smart Business: A Legal Perspective. The seminar covers the triple bottom line, carbon regulation in the US and internationally, and toxin reduction in the product and waste streams. Businesspeople can view the webinar by clicking here. US lawyers who wish to receive free Continuing Legal Education (CLE) credits for watching the webinar can view it by clicking here. John HowleyWoodbridge, New Jersey

The stars are finally aligning for what might be the year of the electric car. Demand will be there as gasoline prices are expected to hit $4 per gallon this summer. Consumers will be able to test drive all-electric vehicles at car rental agencies such as Hertz, and a number of different manufacturers will offer a range of models to choose from. The infrastructure -- a network of electric recharging stations -- is starting to fall into place. There's even an iPhone app that will tell you where the nearest charging station is located. Let's begin with demand for all-electric vehicles. As noted in yesterday's post, most experts expect oil prices to exceed $100 per barrel this year. That means gasoline prices above $4 per gallon this summer. And high prices are most likely here to stay. While most analysts expect that OPEC will try to keep prices in the $100 to $150 range, Morgan Stanley and others question whether they have enough capacity to keep up with increasing demand from China and other emerging economies. If not, then $200 per barrel oil is within the range of possibilities. John Hofmeister, former president of Shell Oil and author of "Why We Hate The Oil Companies," points out that this could mean gasoline at $5 per gallon by 2012. Gasoline at $4 to $5 per gallon will start people thinking about alternatives. Can all-electric cars meet their needs? Car makers and car rental companies are betting that consumers will fall in love with electric cars once they drive them, and so far the reviews have been great. Jim Motavalli, writing in Forbes.com, describes the Nissan Leaf as "impressive, quiet, comfortable, sophisticated, and bristling with high-tech aids to help with charging and plug-in connectivity." He also says that it "handles excellently." In addition to the Nissan Leaf and the Chevy Volt, new all-electric cars are expected this year from BMW, Ford, Mercedes, Mitsubishi, Renault, Subaru, and Toyota in a variety of price ranges. At the top end of the price range, you can even get the very sleek, powerful, and fast all-electric Aston Martin pictured above. A number of other manufacturers are also preparing to enter the market with all-electric vehicles, including China's BYD (backed by Warren Buffett), which is building an all-electric 5-passenger sedan. OK, so the supply of all-electric vehicles and the demand for them might show up this year, but what about the infrastructure needed to recharge them? Turns out that charging stations are already in place, and more can come on line very quickly in response to demand. For example, utilities around the nation are installing recharging stations for electric cars. Hertz has installed charging stations in Manhattan, and will soon be installing more charging stations at select Starwood Hotels. Walmart has been planning to deploy recharging stations in its parking lots across the country, and if that happens it won't be long before Target, Walgreens, CVS, and other national chains follow the lead. The constraint this year may be whether supply of all-electric vehicles can keep up with demand. When the Prius first came out, many prospective buyers found themselves on waiting lists to get one of the now iconic hybrids. The same could happen this year, especially with a federal tax credit of up to $7,500 for electric vehicles plus additional credits from states such as California, Georgia and Tennessee. The longer term, and more troubling issue is whether the electric grid will be "smart" enough to handle the new type of demand for electricity. It is not simply a capacity issue. Existing generation capacity could probably handle tens of thousands of electric cars being recharged during off-peak hours, such as overnight. The problem arises if large numbers of electric cars are being charged during peak demand periods. Ideally, electric cars would act as back-up storage sending electricity back to the grid during peak demand hours and recharging during off-peak hours. But the grid is not yet capable of handling that or billing for it. Building a smarter grid, more than anything else, is the biggest barrier to a future of electric vehicles. John HowleyWoodbridge, New Jersey

Despite the worst economic conditions in half a century, the price of oil doubled over the past two years from a low of about $45 per barrel in 2008 to a high of $92 per barrel on the last day of trading in 2010. This doubling of oil prices occurred as supplies increased by about 1.2 million barrels per day during the past year. Yes, that's right, the price of oil more than doubled during very weak economic conditions and increasing supply. It doesn't take a genius to figure out what will happen as the economy recovers. Demand for oil will increase and the price will trend even higher. Most experts predict oil prices above $100 per barrel in 2011. Lloyd's of London issued a report earlier this year predicting prices as high as $200 per barrel by 2013 and warning of “catastrophic consequences” for businesses that fail to prepare. Some analysts say that the Organization of Petroleum Exporting Countries will step in to increase supply temporarily and cool off markets once oil hits about $150 per barrel. Think about that for a moment. Remember what happened to our economy when oil prices hit $147 per barrel two years ago? Well, that is the best case scenario for the next few years. I don't know about you, but I'm not really comfortable relying on OPEC to keep oil prices from going over $150 per barrel. What if they decide that a price of $175 per barrel will let them maximize profits without losing too much market share to alternative energy sources? What if prices go even higher because of conflicts in the middle east, a major supply disruption, and/or a significant weakening of the U.S. dollar? What if they ask us to ease off the pressure to root out terrorists in their countries in return for lower or more stable oil prices? We can change this scenario without undermining our quality of life. For example, we have reduced our use of oil to generate electricity significantly since the 1970's -- without sacrificing dependability or affordability of supply. We have used more efficient designs to lower fuel consumption per square foot for buildings and per mile driven for vehicles -- without sacrificing comfort or safety.We can do even more by diversifying our energy sources throughout our economy. Yes, it will take significant up front investments. But think about the medium- and long-term benefits. Brazil has completely eliminated its dependence on foreign oil by building the largest biofuels industry in the world. New vehicles powered by electricity generated with a mix of natural gas, wind, and solar could similarly help us re-gain our energy and economic independence. Best of all, the wind farm or solar farm that is built today will have zero fuel costs 5 years, 10 years, and even 20 years from now. Let OPEC compete with that. John Howley

Woodbridge, New Jersey

2010 was the best of times and the worst of times for green energy. Here are a few resolutions to help us make 2011 a Greener and Happier New Year. Resolution #1: Keep The Faith It is easy to get discouraged during a year when the media and Congress ignored an urgent warning from the National Academy of Sciences that Strong Evidence on Climate Change Underscores the Need for Actions to Reduce Emissions.But do not despair. We did make progress this year. Walmart launched a Sustainability Index requiring 100,000 of its suppliers to disclose their energy and water consumption, carbon footprint, waste management practices, and what they are doing to become more green and sustainable. President Obama ordered federal agencies to reduce the federal government's carbon emissions by 28% by the year 2020. Both of these actions are having ripple effects as evidenced by Deloitte LLP acquiring three of the largest carbon consulting firms in the world. Deloitte, IBM, Accenture, McKinsey, and all the other consulting firms are building sustainability practices because their clients know that being profitable in the 21st century means finding ways to reduce waste and becoming more sustainable. So resolve to keep the faith in 2011. We are making progress. Resolution #2: Share the NewsEdward R. Murrow, Walter Cronkite, and other low-key, professional newscasters have been replaced with jesters and snake-oil salesmen. Traditional media are desperately trying to get our attention because we no longer rely exclusively on them for news. Most of us get our news from many different sources including, most importantly, our social networks. Think about how many times you have found a story or a video because a friend sent it to you via email or posted it on your favorite social networking site. That, my friends, is how we will continue to build upon the growing consensus in support of green and sustainable energy. When you see an interesting article / video / podcast on green energy or climate change or sustainable business practices, post it and share it with your friends. Some of them will share it with their friends. Sometimes it will even go viral. So resolve to share the news. We can change the world by sharing. Resolution #3: Think and Choose GreenMany of us have made greener choices when buying cars based on their fuel efficiency rating or when buying appliances based on their EnergyStar rating. This makes sense because a single decision will save energy, save money, and reduce environmental impacts for many years. There is another choice that we should be making and that has only become available in the past 5 years or so. That is choosing where our electricity comes from.In many states, you have the right to tell your utility to get your electricity from green and sustainable sources. It does not cost any more than you pay now, and it often costs less to choose greener energy. I've done this for my own home. We now get greener energy for 12.4% less than we were paying before. You can click here to find out how you can choose greener energy at an affordable price for your home or business. It's free, it's easy, it will help the environment, and it could save you money. And it will increase the demand for sustainable energy. So resolve to think and choose green whenever you can. We can make a difference. Happy New Year!John HowleyWoodbridge, New Jersey

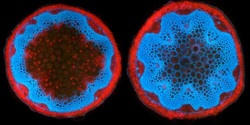

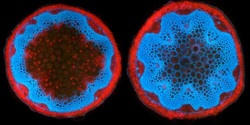

Scientists at The Samuel Roberts Noble Foundation in Ardmore, Oklahoma, have uncovered a gene that could revolutionize the biofuels industry in the United States. The gene is responsible for controlling the density of plant material. By removing the gene, farmers can grow denser plants that produce more biomass from the same acreage. In short, more energy from the same amount of land and less conflict with land needed to grow food.

Huanzhong Wang, Ph.D., a postdoctoral fellow at the foundation, found a gene that controls the production of lignin in the central portions of the stems of Arabidopsis and Medicago truncatula, species commonly used as models for the study of plant genetic processes. Lignin is a compound that helps provide strength to plant cell walls, basically giving the plant the ability to stand upright. When the newly discovered gene is removed, there is a dramatic increase in the production of biomass, including lignin, throughout the stem.

Increasing lignin in non-food crops, such as switchgrass, may increase the density of the biomass and produce more feedstock per plant. Compared to corn- or soybean-based biofuels, switchgrass and other low-input grassland perrenials can provide more usuable energy, greater greenhouse gas reductions, and less agricultural pollution per acre. In addition, many of the grass varieties can be grown on agriculturally degraded land, are drought and salt tolerant, and therefore can be grown on land that is not used for food production. Perrenial grasses also offer an excellent habitat for a wide variety of birds and small mammals.

"In switchgrass, as the plant matures, the stem becomes hollow like bamboo," said Dr. Richard Dixon, director of the Noble Foundation's Plant Biology Division. "Imagine if you use this discovery to fill that hollow portion with lignin. The potential increase in biomass in these new plants could be dramatic. This technology could make plants better suited to serve as renewable energy sources or as renewable feedstocks to produce advanced composite materials that consumers depend on every day."

Collaboration with scientists at the University of Georgia revealed that removing the gene also increases the production of carbohydrate-rich cellulose and hemicellulose material in portions of the plant stem. These are the components of a plant that are converted to sugars to create advanced biofuels, such as cellulosic-derived ethanol or butanol. More celluloses and hemicelluloses mean more sugars to use for carbohydrate-based energy production.

Biofuels have already shown that they can help even a large nation wean itself from foreign oil. Brazil has eliminated its dependence on foreign oil by using ethanol from sugar cane to meet most of its fuel needs. Increased lignin production in switchgrass and other perennial grasses could help the US reach energy independence as well.

John Howley

Woodbridge, New Jersey

Investors are betting billions of dollars that oil will flow freely from wells being drilled in Kurdistan. The Financial Times reports that one small oil exploration company, Gulf Keystone Petroleum, already has a market capitalization of $1.9 billion, which would put it on the FTSE 250 index if it gets listed on the London Stock Exchange. Not bad for a company that has no proven reserves, has never earned any money for its investors, and has run operating losses every year of its existence. Of course, Kurdistan is a pretty dangerous and unstable place. Just because you find oil today doesn't mean you will get to profit from it in the future. So why does this company have a market capitalization of almost two billion dollars? Analysts say it is because investors are very confident that there are large oil reserves in the parts of Kurdistan where Gulf Keystone has been drilling. In fact, Gulf Keystone hit oil with its first well drilled in August 2009.Ok. I can understand that line of thought. But this oil is in Kurdistan, a place that has been in almost continual violent conflict with Iraq since it was first recognized as an autonomous region in 1970. What about the very significant risks of violence, war, or even just political instability? How can a company afford all the security and insurance that must be necessary to cover those risks. This is where we start to understand how the oil industry benefits from costs assumed by others. The ability to drill for oil in Kurdistan is a direct result of the hundreds of billions of dollars our governments have spent on the Iraq war and the ensuing seven years of efforts to stabilize that country. The door was opened, and it remains open, because of huge government investments and the personal sacrifices of hundreds of thousands of American, British, and other troops, including almost 5,000 Americans who lost their lives and more than 30,000 who were seriously wounded. Next time we fill up our cars with relatively inexpensive gasoline, let's remember the hidden costs that are not reflected in the price. And let's also keep those costs in mind when we consider government investments in sustainable alternatives. John HowleyWoodbridge, New Jersey

|

RSS Feed

RSS Feed